About us

"We assist you finding the best solution to your property needs"

Hamptons Realty is the real estate agency in Indonesia specializing in International Property, such as Australia, Singapore, Malaysia, United Kingdom, California and many more.

Read More

10+

Years Experience

500

Our Property

230

Our Client

370

Our Partner

Our Superiority

Service

Delivering a one-stop solution to meet different real estate needs

Relationship

Building on trust and integrity to develop long-term relationships

Technology

Providing real-time advisory to make better decisions

Collaboration

Creating favorable environment to drive exceptional results

Social Responsibility

Doing what is right to benefit communities and environment

Our Project

WE HAVE THE RIGHT PROPERTY FOR YOU

Various projects from many countries to choose to suit your needs

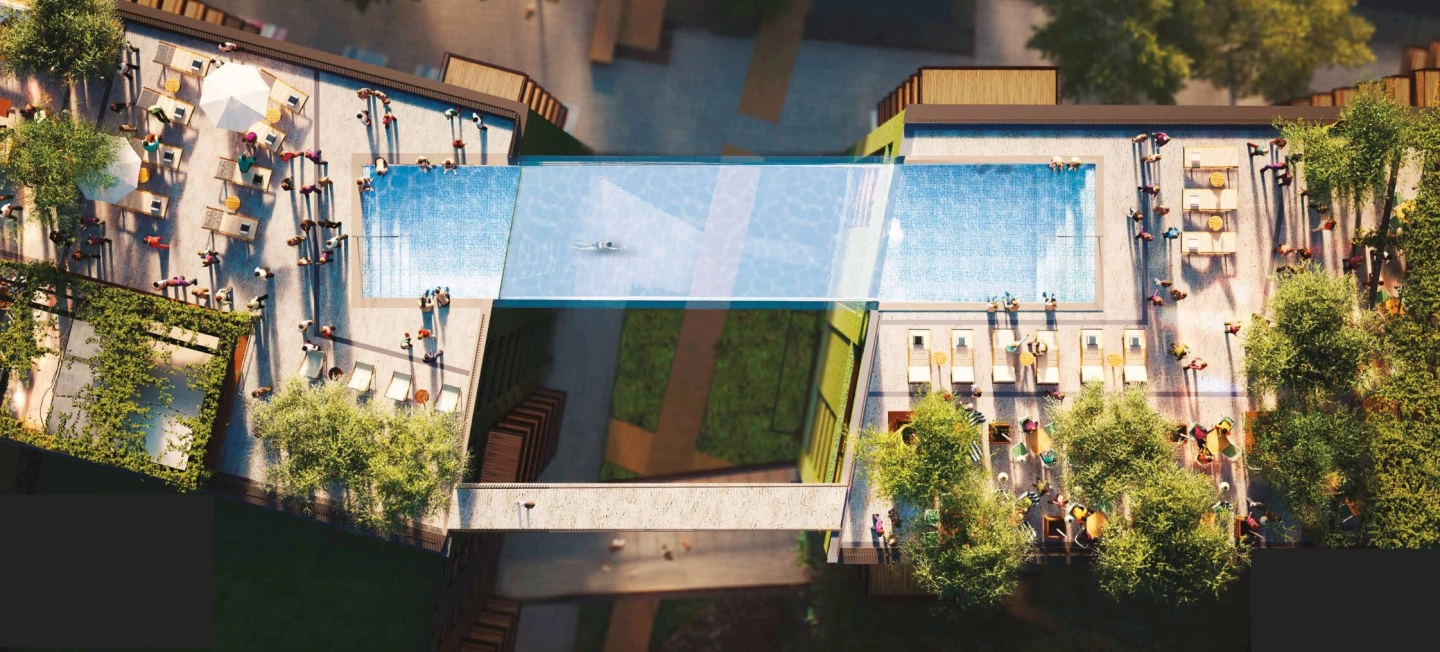

Sengkang Grand Residences

• SGR is an upscale new Condominium located at Compassvale Bow, District 19.

• Luxurious Integrated Development at Buangkok MRT comprise of Residential, Shopping, Community and Transport.

• There are several Bus feeders services available within the Vicinity.

• Surrounded by Schools, Clinics, Shopping Malls and Shops.

• The Convenience of Integrated Amenities and Recreational facilities such as Hawker Centre, Childcare Centre and Civic Plaza which forms a Vibrant Community.

PROJECT

• The project is a 99-year Leasehold Development consisting of 680 units.

• There are 9 residential towers with range from 1 Bedroom + Study unit to 4 Bedroom Premium + Flexi units.

• The Development blends distinctive Architecture feature with lush Landscaping and Community programming.

• Sports and Recreational Activities utilizing the Facilities provided such as a Parkour Gym, Treetop Walk, Five senses Garden, Trampoline, Community Club and Swimming Pools.

• Developer: Capitaland & City Developments Limited (CDL)

•Hand Over: 2023.

• Luxurious Integrated Development at Buangkok MRT comprise of Residential, Shopping, Community and Transport.

• There are several Bus feeders services available within the Vicinity.

• Surrounded by Schools, Clinics, Shopping Malls and Shops.

• The Convenience of Integrated Amenities and Recreational facilities such as Hawker Centre, Childcare Centre and Civic Plaza which forms a Vibrant Community.

PROJECT

• The project is a 99-year Leasehold Development consisting of 680 units.

• There are 9 residential towers with range from 1 Bedroom + Study unit to 4 Bedroom Premium + Flexi units.

• The Development blends distinctive Architecture feature with lush Landscaping and Community programming.

• Sports and Recreational Activities utilizing the Facilities provided such as a Parkour Gym, Treetop Walk, Five senses Garden, Trampoline, Community Club and Swimming Pools.

• Developer: Capitaland & City Developments Limited (CDL)

•Hand Over: 2023.

DAMAC Sun City Townhouses @ Cherrywoods

Located at the prime hotspot of Dubailand, offering seamless connectivity to the key famous landmarks and pristine leisure venues.

PROJECTS

Set within a vast 42 million square feet development in Dubai, offer a remarkable fusion of modern living spaces, from chic apartments to stylish villas and townhouses.

Features unique amenities such as Ice bath station, outdoor sauna cabins, and gym that seamlessly connected with natural rhythms.

Engage in the fun and challenging workouts at the monkey bar area, an outdoor fitness space that promotes movement, agility, and holistic wellness.

From outdoor yoga areas and forest hiking trails to a wild garden amphitheatre, it integrates nature with luxury living.

Each residence at DAMAC Sun City is thoughtfully designed for both comfort and wellness, with spacious balconies and terraces that invite you to enjoy the outdoors. This community centres around wellness-focused family living, creating calm spaces that promote health and happiness.

The new premium collection of 4 and 5 bedroom townhouses design incorporates modern aesthetic and natural materials, with expansive glass façades that blur the lines between indoor and outdoor environment.

4 Bedroom start from AED 2.25 Million

5 Bedroom start from AED 3.01 Million

Hand Over: March 2028

PROJECTS

Set within a vast 42 million square feet development in Dubai, offer a remarkable fusion of modern living spaces, from chic apartments to stylish villas and townhouses.

Features unique amenities such as Ice bath station, outdoor sauna cabins, and gym that seamlessly connected with natural rhythms.

Engage in the fun and challenging workouts at the monkey bar area, an outdoor fitness space that promotes movement, agility, and holistic wellness.

From outdoor yoga areas and forest hiking trails to a wild garden amphitheatre, it integrates nature with luxury living.

Each residence at DAMAC Sun City is thoughtfully designed for both comfort and wellness, with spacious balconies and terraces that invite you to enjoy the outdoors. This community centres around wellness-focused family living, creating calm spaces that promote health and happiness.

The new premium collection of 4 and 5 bedroom townhouses design incorporates modern aesthetic and natural materials, with expansive glass façades that blur the lines between indoor and outdoor environment.

4 Bedroom start from AED 2.25 Million

5 Bedroom start from AED 3.01 Million

Hand Over: March 2028

Capital Cove

● Capital Cove is the Latest Innovative Business Loft from BSD City.

● Strategically located at the Primary road of BSD Grand Boulevard with expansive 40 meter ROW.

● Next to Sinarmas Academy.

● Surrounding: Green Office Park, Unilever, Menara BNI, Nava Park, EKA Hospital, Ice BSD, Teraskota, etc.

● Just take 5 minutes to the Current and Future Jakarta – Serpong tollgate.

PROJECT

● The public area surrounding the Capital Cove is carefully Designed. Wide and comfortable Pedestrian allowing people to enjoy the walk and scenery.

● There are Five spacious drop-off points built around the compound with the Corridor Terrace has about 7,5 meter High Ceiling to give a Grand Entrance for each business that resides in the area.

● The Modern Contemporary Building Façade is designed with a fully Expansive Glass Window to make it a powerful Business Showcase.

● The Innovation on its Fully Independent Floor Management is making Capital Cove the First True Multi-tenant Business Loft.

● Every Top Floor is a VIP Floor. Some Units includes an Expansive Balcony to create an Outdoor Office Expansion or Private Function with a Great View.

● Developer: Sinarmas Land

● Hand Over: 2024

● Strategically located at the Primary road of BSD Grand Boulevard with expansive 40 meter ROW.

● Next to Sinarmas Academy.

● Surrounding: Green Office Park, Unilever, Menara BNI, Nava Park, EKA Hospital, Ice BSD, Teraskota, etc.

● Just take 5 minutes to the Current and Future Jakarta – Serpong tollgate.

PROJECT

● The public area surrounding the Capital Cove is carefully Designed. Wide and comfortable Pedestrian allowing people to enjoy the walk and scenery.

● There are Five spacious drop-off points built around the compound with the Corridor Terrace has about 7,5 meter High Ceiling to give a Grand Entrance for each business that resides in the area.

● The Modern Contemporary Building Façade is designed with a fully Expansive Glass Window to make it a powerful Business Showcase.

● The Innovation on its Fully Independent Floor Management is making Capital Cove the First True Multi-tenant Business Loft.

● Every Top Floor is a VIP Floor. Some Units includes an Expansive Balcony to create an Outdoor Office Expansion or Private Function with a Great View.

● Developer: Sinarmas Land

● Hand Over: 2024

Latest News

01 December 2025

Expert predicts further gains for sellers as Australian house prices rise for another month

It’s full steam ahead for the real estate market coming into Christmas with a new report revealing nationwide home value growth over the past month.

The December edition of PropTrack’s Home Price Index showed national home prices rose by 0.51 per cent in November, pushing annual growth for all dwellings to 8.7 per cent.

Australian houses rose by ,700 for the year, to now sit at a median value of 9,000. Units grew by ,400 to reach 3,000.

Three interest rate cuts this year, in addition to population inflow, investor activity and the federal government’s expanded home guarantee scheme were key factors in driving price growth, according to REA Group senior economist Eleanor Creagh.

“These will continue to bolster demand, along with upgrade activity,” Ms Creagh said. “Meanwhile, stock on market has been pretty tight this year, despite having seen an uplift over the past month with the spring selling surge.”

Regional areas led the way, growing by 0.6 per cent for the month and 9.26 per cent annually, while capital cities grew 0.48 per cent and 8.54 per cent for month and year respectively.

Perth remains the strongest performing capital, with 0.9 per cent growth for the month bringing its annual surge to 15.5 per cent.

Adelaide matched Perth’s monthly growth and now sits 12.2 per cent higher for the year, while Brisbane’s 0.64 per cent growth has pushed its annual growth to 13.68 per cent.

“We have seen momentum broadening this year, with price growth re-accelerating in Sydney and Melbourne, but also in Hobart and Darwin,” Ms Creagh said. “In terms of annual growth, Darwin is actually the second strongest market in the country, outpaced only by Perth.

“There’s been a very clear acceleration in the pace of growth in Darwin and a very clear turnaround in market conditions.”

Ms Creagh said there were several factors that could slow growth in 2026

“Broadly, it looks like further price gains into summer, although the extended pause on interest rates and APRA’s cap on high debt to income lending is probably going to temper momentum into the first half of 2026,” she said. “So we could see the pace of growth easing off slightly.”

However, she believes the underlying lack of supply across the nation will “put a floor under home prices”.

“The delivery of new housing remains constrained, so conditions have been tilted towards sellers and I’d say that’s going to remain the case,” she said. “Building approvals, which are really the best case scenario of what gets built, are still tracking well below target.

“It doesn’t look like we’re going to see a surge in completions, but I’d probably say we’re moving from maybe acute stress toward gradual recovery.”

https://www.realestate.com.au/news/expert-predicts-further-gains-for-sellers-as-australian-house-prices-rise-for-another-month/

The December edition of PropTrack’s Home Price Index showed national home prices rose by 0.51 per cent in November, pushing annual growth for all dwellings to 8.7 per cent.

Australian houses rose by ,700 for the year, to now sit at a median value of 9,000. Units grew by ,400 to reach 3,000.

Three interest rate cuts this year, in addition to population inflow, investor activity and the federal government’s expanded home guarantee scheme were key factors in driving price growth, according to REA Group senior economist Eleanor Creagh.

“These will continue to bolster demand, along with upgrade activity,” Ms Creagh said. “Meanwhile, stock on market has been pretty tight this year, despite having seen an uplift over the past month with the spring selling surge.”

Regional areas led the way, growing by 0.6 per cent for the month and 9.26 per cent annually, while capital cities grew 0.48 per cent and 8.54 per cent for month and year respectively.

Perth remains the strongest performing capital, with 0.9 per cent growth for the month bringing its annual surge to 15.5 per cent.

Adelaide matched Perth’s monthly growth and now sits 12.2 per cent higher for the year, while Brisbane’s 0.64 per cent growth has pushed its annual growth to 13.68 per cent.

“We have seen momentum broadening this year, with price growth re-accelerating in Sydney and Melbourne, but also in Hobart and Darwin,” Ms Creagh said. “In terms of annual growth, Darwin is actually the second strongest market in the country, outpaced only by Perth.

“There’s been a very clear acceleration in the pace of growth in Darwin and a very clear turnaround in market conditions.”

Ms Creagh said there were several factors that could slow growth in 2026

“Broadly, it looks like further price gains into summer, although the extended pause on interest rates and APRA’s cap on high debt to income lending is probably going to temper momentum into the first half of 2026,” she said. “So we could see the pace of growth easing off slightly.”

However, she believes the underlying lack of supply across the nation will “put a floor under home prices”.

“The delivery of new housing remains constrained, so conditions have been tilted towards sellers and I’d say that’s going to remain the case,” she said. “Building approvals, which are really the best case scenario of what gets built, are still tracking well below target.

“It doesn’t look like we’re going to see a surge in completions, but I’d probably say we’re moving from maybe acute stress toward gradual recovery.”

https://www.realestate.com.au/news/expert-predicts-further-gains-for-sellers-as-australian-house-prices-rise-for-another-month/

06 November 2025

Hundreds of People Defrauded of Buying Property, Total Losses Reach Rp 188 Billion

Jakarta, CNBC Indonesia - Mumbai police registered a major real estate fraud case on Wednesday. This case involves a property developer who defrauded hundreds of homebuyers out of 100 crore rupees (Rp 188 billion).

This case adds to the long list of fraud scandals in India's real estate sector. The developer then diverted the funds for the personal benefit of the owner and his wife.

Citing Rediff, Thursday (6/10/2025), the first case was opened by the Mumbai Police's Economic Offences Wing (EOW). The initial investigation was based on a complaint filed by Anil Dron, a 62-year-old public accountant and a Mumbai resident.

Authorities then identified the main accused as a real estate developer named Subbaraman Anand Vilaynur and his wife, Uma Subbaraman. Their company, B P Gangar Constructions, and several other parties were also charged.

It is reported that around 102 people have been defrauded of 1 billion rupees since 2018. The funds were collected by promising to sell apartment units in a housing project called 'Sky 31' located in Wadala (West), Mumbai.

"However, after collecting the money from the victims, the accused allegedly conspired to divert the funds to their personal bank accounts and other accounts, instead of using them for the promised housing project development," the EOW said.

The fraudulent scheme was further compounded by the discovery that the accused also sold one flat to two different individuals. They received money from both buyers, resulting in double losses.

The EOW has now registered a case against the accused on charges of cheating and criminal breach of trust. A thorough investigation into the case is underway to uncover the entire network and the flow of misappropriated funds.

https://www.cnbcindonesia.com/news/20251106142143-4-682889/ratusan-orang-tertipu-beli-properti-total-kerugian-rp-188-m

This case adds to the long list of fraud scandals in India's real estate sector. The developer then diverted the funds for the personal benefit of the owner and his wife.

Citing Rediff, Thursday (6/10/2025), the first case was opened by the Mumbai Police's Economic Offences Wing (EOW). The initial investigation was based on a complaint filed by Anil Dron, a 62-year-old public accountant and a Mumbai resident.

Authorities then identified the main accused as a real estate developer named Subbaraman Anand Vilaynur and his wife, Uma Subbaraman. Their company, B P Gangar Constructions, and several other parties were also charged.

It is reported that around 102 people have been defrauded of 1 billion rupees since 2018. The funds were collected by promising to sell apartment units in a housing project called 'Sky 31' located in Wadala (West), Mumbai.

"However, after collecting the money from the victims, the accused allegedly conspired to divert the funds to their personal bank accounts and other accounts, instead of using them for the promised housing project development," the EOW said.

The fraudulent scheme was further compounded by the discovery that the accused also sold one flat to two different individuals. They received money from both buyers, resulting in double losses.

The EOW has now registered a case against the accused on charges of cheating and criminal breach of trust. A thorough investigation into the case is underway to uncover the entire network and the flow of misappropriated funds.

https://www.cnbcindonesia.com/news/20251106142143-4-682889/ratusan-orang-tertipu-beli-properti-total-kerugian-rp-188-m

06 October 2025

Why first home buyers rushed to buy Tarneit land

Richard and Regine Fuertes knew land prices were only going upwards, so when the chance came to buy in Tarneit, they grabbed it.

“We could see the way land prices were moving,” Mr Fuertes said.

“We realised that by next year, property values were only going to keep rising. When this opportunity came up, we didn’t want to wait. It feels like the right decision for our future.”

For the couple from Melbourne’s west, the purchase marks their very first step into the property market.

They had never seriously looked before, but when the federal government announced it was adjusting the First Home Guarantee, Mr Fuertes said timing was suddenly working in their favour.

“Honestly, this was our very first attempt at buying, we hadn’t been through the process before,” he said.

“But we were fortunate, the government changed the scheme at just the right time, and it made all the difference. We feel blessed and excited it’s worked out.”

The Fuertes family also knew they didn’t want to compromise on location.

While some buyers are being pushed further out to the city fringe, they were determined to stay close to the people and places that mattered most to their family.

“We didn’t want to move away,” Mr Fuertes said.

“This is where our life is, and it made sense to stay.”

But Mr Fuertes said the smaller block didn’t faze him.

“For me, the size doesn’t matter too much,” he said.

“What mattered most was having a home we could call our own. That was the dream, and now it’s happening.”

With sales volumes surging and developers winding back incentives, experts warn prices could climb again by early 2026 which Mr Fuertes said added to the urgency of making their move now.

“It’s such a relief,” he said.

“We’re very excited, it feels like a new beginning, and we can’t wait to start building memories in our own home.”

https://www.realestate.com.au/news/why-first-home-buyers-rushed-to-buy-tarneit-land/

“We could see the way land prices were moving,” Mr Fuertes said.

“We realised that by next year, property values were only going to keep rising. When this opportunity came up, we didn’t want to wait. It feels like the right decision for our future.”

For the couple from Melbourne’s west, the purchase marks their very first step into the property market.

They had never seriously looked before, but when the federal government announced it was adjusting the First Home Guarantee, Mr Fuertes said timing was suddenly working in their favour.

“Honestly, this was our very first attempt at buying, we hadn’t been through the process before,” he said.

“But we were fortunate, the government changed the scheme at just the right time, and it made all the difference. We feel blessed and excited it’s worked out.”

The Fuertes family also knew they didn’t want to compromise on location.

While some buyers are being pushed further out to the city fringe, they were determined to stay close to the people and places that mattered most to their family.

“We didn’t want to move away,” Mr Fuertes said.

“This is where our life is, and it made sense to stay.”

But Mr Fuertes said the smaller block didn’t faze him.

“For me, the size doesn’t matter too much,” he said.

“What mattered most was having a home we could call our own. That was the dream, and now it’s happening.”

With sales volumes surging and developers winding back incentives, experts warn prices could climb again by early 2026 which Mr Fuertes said added to the urgency of making their move now.

“It’s such a relief,” he said.

“We’re very excited, it feels like a new beginning, and we can’t wait to start building memories in our own home.”

https://www.realestate.com.au/news/why-first-home-buyers-rushed-to-buy-tarneit-land/

JUAL PROPERTI AUSTRALIA DAN NEGARA LAIN

Jual properti luar negeri adalah keahlian kami. Hamptons Realty berpengalaman lebih dari 10 tahun serta banyak pilihan proyek di negara Australia, Singapura, Inggris, Amerika Serikat dan Malaysia. Kami juga menawarkan solusi satu atap. Hal ini menjadikan kami sebagai agensi properti pilihan anda.